Revealing the Conveniences of Opting for Offshore Company Development

Checking out the world of overseas company development reveals a myriad of benefits that can dramatically impact individuals and organizations alike. From tax advantages to boosted possession defense, the allure of offshore company formation exists in its capability to optimize economic techniques and broaden worldwide reach.

Tax Benefits

Additionally, offshore companies can take part in tax planning strategies that might not be readily available in their residential countries, such as making use of tax treaties between territories to lower withholding taxes on cross-border transactions. This flexibility in tax obligation preparation allows companies to boost their worldwide procedures while managing their tax exposure properly.

Furthermore, offshore companies can gain from asset protection benefits, as assets held within these entities might be shielded from certain lawful claims or lenders. This added layer of security can safeguard company properties and protect wide range for future generations. In general, the tax benefits of developing an offshore business can supply businesses an affordable side in today's worldwide marketplace.

Possession Security

Enhancing the safety and security of company properties with calculated planning is a primary goal of offshore company development. Offshore entities provide a durable framework for protecting possessions from prospective risks such as lawsuits, financial institutions, or political instability in residential jurisdictions. By establishing a firm in a secure overseas territory with positive asset security people, legislations and organizations can shield their wide range from different threats.

Among the key advantages of overseas business formation in regards to possession protection is privacy. Many overseas territories offer strict personal privacy regulations that permit business to preserve anonymity concerning their ownership structure. offshore company formation. This confidentiality makes it challenging for outside events to identify and target certain properties held within the offshore entity

Additionally, overseas structures usually have provisions that make it challenging for lenders to accessibility possessions held within these entities. Through lawful mechanisms like asset security trusts or particular provisions in corporate documents, people can add layers of security to protect their wide range from possible seizure.

Increased Privacy

Additionally, several offshore territories do not need the disclosure of beneficial proprietors or shareholders in public records, including an additional layer of personal privacy security. This discretion can be especially beneficial for prominent people, entrepreneurs, and organizations looking to prevent undesirable interest or shield sensitive monetary details. In general, the boosted privacy provided by overseas company formation can supply assurance and a complacency for those looking to keep their monetary events safe and secure and very discreet.

Global Market Gain Access To

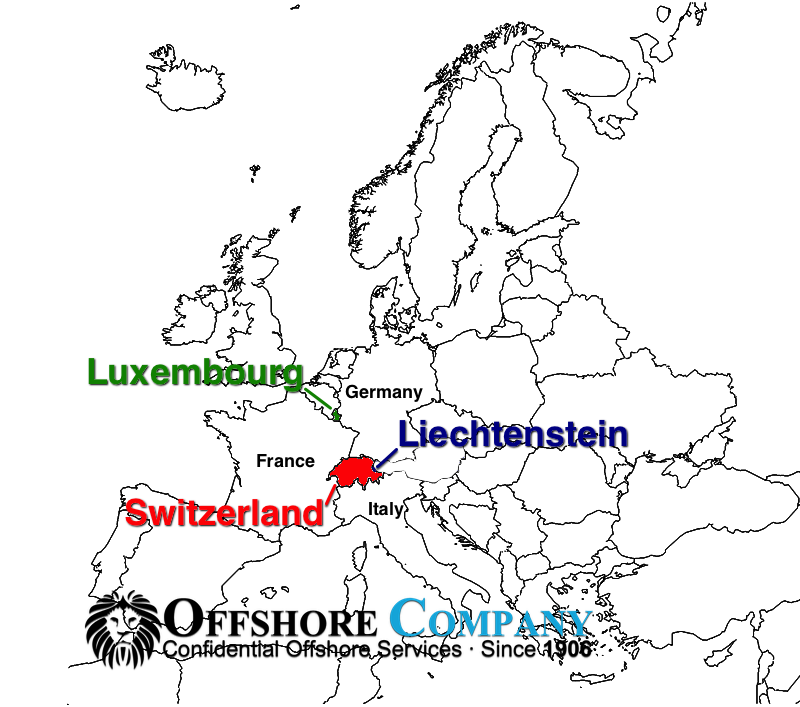

With the facility of an overseas company, companies get the critical advantage of taking advantage of international markets with raised ease and efficiency. Offshore business development supplies firms with the possibility to access a broader customer base and explore new service leads on an This Site international range. By establishing procedures in overseas jurisdictions known for their business-friendly regulations and tax incentives, companies can expand their reach beyond domestic borders.

Global market access through overseas firm development additionally enables businesses to develop global integrity and presence. Running from a jurisdiction that is recognized for its security and pro-business setting can boost the online reputation of the firm in the eyes of worldwide partners, investors, and customers. This raised credibility can open up doors to collaborations, partnerships, and opportunities that may not have actually been quickly accessible through an only residential company method.

Furthermore, overseas business can benefit from the varied variety of resources, abilities, and market understandings available in various parts of the world. By leveraging these international resources, businesses can get an one-upmanship and remain ahead in today's interconnected and vibrant business landscape.

Lawful Compliance

Abiding by legal conformity is critical for offshore companies to make sure regulatory adherence and threat visit this page mitigation in their operations. Offshore companies need to navigate a complicated regulatory landscape, usually subject to both neighborhood laws in the territory of incorporation and the worldwide laws of the home country. Failing to comply with these lawful requirements can lead to extreme consequences, consisting of penalties, lawsuits, and even the abrogation of the overseas company's permit to run.

To maintain lawful conformity, offshore business commonly engage legal specialists with knowledge of both the regional guidelines in the overseas jurisdiction and the international legislations relevant to their operations. These legal experts aid in structuring the overseas company in a way that makes sure conformity while taking full advantage of functional performance and profitability within the bounds of the legislation.

Additionally, remaining abreast of advancing lawful requirements is essential for offshore business to adjust their procedures as necessary. By focusing on lawful conformity, overseas firms can construct a strong structure for lasting development and lasting success in the international market.

Conclusion

To conclude, offshore company development supplies numerous advantages such as tax obligation benefits, possession security, boosted privacy, worldwide market gain access to, and legal compliance. These benefits make overseas business an appealing choice for companies wanting to expand their procedures worldwide and maximize their monetary techniques. By making the most of overseas firm development, companies can enhance their affordable side and setting themselves for long-term success in the international industry.

The establishment of an offshore firm can supply considerable tax benefits for Go Here organizations seeking to optimize their economic frameworks. By setting up an overseas business in a tax-efficient jurisdiction, organizations can lawfully minimize their tax obligation obligations and retain even more of their revenues.

Overall, the tax obligation advantages of developing an offshore firm can use businesses an affordable edge in today's international market. offshore company formation.

Enhancing the security of service assets via tactical preparation is a primary purpose of offshore firm development. Offshore firm formation gives companies with the possibility to access a more comprehensive customer base and discover brand-new service potential customers on a global scale.